I’m selling a property, what do I need to do about Capital Gains Tax?

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

In the last few months, a small minority of my clients that were not landlords have sold residential properties with a capital gain that needed to be reported that I was unaware of until a chance conversation. These were sales of inherited property and therefore that discussion hadn’t been prompted when discussing their affairs. They were unaware that a return was required and I was unaware that they had a property to dispose of. I now want to make sure that as many people as possible are aware of the need for these returns because (you guessed it) there are penalties for failure to complete them.

What is Capital Gains Tax?

Capital Gains Tax is a tax that you pay when you dispose of an asset that has increased in value over time. You only need to pay tax on the gain you have made since purchasing or inheriting the object. It most usually applies to sales of property, shares or businesses. When the gain arises from the sale of a residential property and there is tax to be paid on your gain, you need to submit a tax return to HMRC within 60 days of the sale being agreed (exchange of contracts or completion of missive – usually earlier than the date of the sale).

What if its my home that I sold?

If you sell your only property that you have lived in since buying it, then any gain on sale will be covered by Principal Private Residence Relief. There will be no Capital Gains Tax due and there is no need to report the sale to HMRC.

Its fairly common for people to buy a property and live in it for a while, then they may move out and rent it out for a while before selling it. If you have lived in the property for some of the time, you will be granted principal private residence relief on the portion of the gain that covers the time you lived in the property. There may, however still be a taxable gain on the portion that doesn’t attract the principal private residence relief and this may need to be reported within 60 days of agreeing the sale.

If you have never lived in the property, there is no principal private residence relief available and the whole of the gain will be subject to capital gains tax.

Here is a link to an HMRC calculator that may help you decide whether you need to complete the return.

When did you sell or give away the property? - Calculate your Capital Gains Tax - GOV.UK

Note that if you are in the business of buying and selling properties as a trade, then any profits may be subject to income tax instead. We don’t cover this scenario at Armet Accounting, you should find an accountant that specialises in property taxes.

I need to submit a return, what do I need to do now?

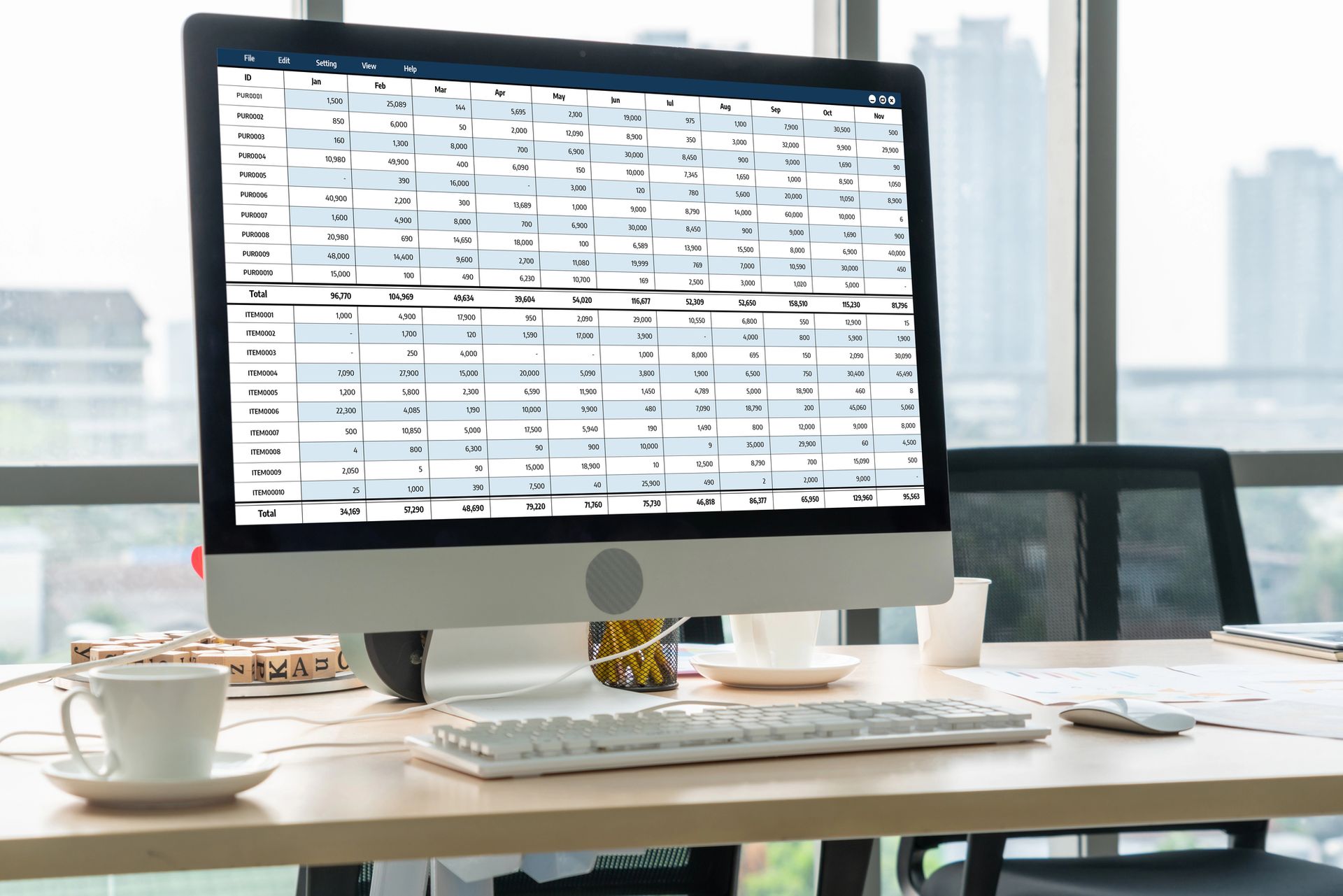

Make sure that you gather all the information you are going to need to complete the return. This might include

- How much you paid for the property or the market value on the date you inherited it

- How much you spent improving the property

- How much you spent on fees to purchase the property

- Sales proceeds

- How much you spent on fees to sell the property

- Dates you moved in and out of the property

- Dates of purchase and sale of the property

- How much you are likely to earn through other sources of income in the tax year you have sold the property

Set up your government gateway account for Capital Gains Tax reporting by clicking on the link below.

Create a new government gateway account

Create a new government gateway account by clicking on create sign in details.

If an accountant is going to submit the return for you, you will need to let them know your account reference number so that they can become authorised to submit the return on your behalf. If you are completing the return yourself, you should populate all areas of the return. It will ask you for the information you have gathered and help you calculate the capital gains tax that may be due.

Once you are happy with the entries, you can submit the return and you will be given a payment reference to enable you to make the payment within the 60 day deadline.

I’ve submitted the 60 day Capital Gains Tax return, what now?

If you are not in the self-assessment regime and the tax that was calculated in the 60 day return was correct then there is no need to submit a self-assessment return as well. Otherwise, you should still report the gain in your self-assessment return and include a note that includes the reference number of the return that you submitted.

If any additional tax is due, for example because you earned more in the tax year than you expected to, then you will need to pay the difference with your self-assessment payment. Beware that interest may be charged on any underpayment. If there is less tax due for example because you made subsequent capital losses that you could set against the gain, it’s a lot harder to get the overpaid funds back from HMRC!

Summary

There is no need to do a return for your home where you have lived in it for the whole time you have owned the property.

There is also no need to do a return if the gain is within your capital gains exempt amount for the tax year in question, although this amount is decreasing over the next few tax years so this will be increasingly rare.

Otherwise, if you dispose of a property you will need to complete a return and pay any tax due within 60 days of the sale being arranged. If you miss this deadline, there will be a £100 penalty and interest will be charged from when you should have paid the tax to the date that HMRC receive the payment.

I would recommend that you get help completing the return from a qualified accountant, especially if you have lived in the property for some of the time that you have owned it and are therefore entitled to some Principal Private Residence relief on the gain.

Note that other Capital Gains Tax reliefs are available but are not covered here.