What can I expect if I ask an accountant to help me with my self-assessment return?

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.

How do we get started?

The self-assessment return encapsulates many different sources of income so everyone’s return is different and so there may be slight tweaks to the basic process that are specific to you. The overall process operates using the following steps.

If Armet Accounting provides you with other services such as VAT, payroll or bookkeeping, you will find there is more frequent contact throughout your financial year than just at the point of completing your tax return.

Initial steps

As part of the process of becoming a client, we will have a discussion about the sources of income that you need to declare on your tax return. You can arrange a discussion by booking a discovery call here. This will allow us to send you a quote for the services you need.

If you choose to go ahead, we will send you an engagement letter that will set out what we will do for you and what we need you to do for us. We will also ask you for personal information that will allow us to request authorisation from HMRC and complete our anti-money laundering process, find out more about the anti-money laundering process here.

Once the end of the tax year has passed

If we don’t have regular access to your records through bookkeeping software, we will request your documents for the year which could include bank statements, invoices, receipts and any records that you have kept through the year. We stagger these emails to ensure that we maintain a manageable workload. We base the timing of these requests roughly on when the information was provided in the previous tax year. There is no need to wait until you hear from us, you can send over any information you have whenever you are ready.

We will use the information you send us to produce a set of draft accounts (if you have a self-employment) and tax return or to produce a list of additional documents that we need you to provide us with.

We will upload the draft accounts and tax return to a file sharing website for you to review and invite you to book a meeting to discuss the accounts.

Once we have processed your information

We will have a meeting to review the accounts and tax return, discuss any options available to you and we can answer any questions you have on the accounts or about anything for the year ahead.

The return may need some further tweaking after this stage. Following the meeting, a finalised return will be uploaded for approval. If a further meeting is required, we will be back in touch.

Once we are ready for submission

You will approve the return, which includes confirming that you have declared all of your income for the tax year in question. At the moment this is usually by electronic approval, although paper copies and physical signatures can be arranged if you wish.

We will submit your self-assessment tax return to HMRC. Once the return has been submitted, we will send you information regarding how much tax to pay, when and how to pay it.

If you have not been on a monthly payment plan we will send out our invoice, which will be due for immediate payment once the return is submitted.

What do we need you to do?

We need you to provide information for all sources of income, it is your responsibility to declare everything that is required. If you are in any doubt as to whether something is taxable, you should speak to us about it. Sensitive documents should be uploaded to your client portal as far as possible.

The quicker you respond to information requests, the quicker we can draft your tax return and give you as much notice as possible of you tax payments.

What can you expect from Armet Accounting?

Along with the usual expectations of an accountant (confidentiality etc), you can expect us to have a first look at your tax return as quickly as we can and revert to you with any questions we have. We aim to complete your self-assessment return within 6 weeks of you providing your information to us, often sooner. This is dependent on you responding to our communications quickly.

We will try and communicate with you using your preferred option (email, WhatsApp, Messnger etc) but our main communication method is email. We use secure document sharing websites to share sensitive information and documents.

What are the changes to self-assessment coming up?

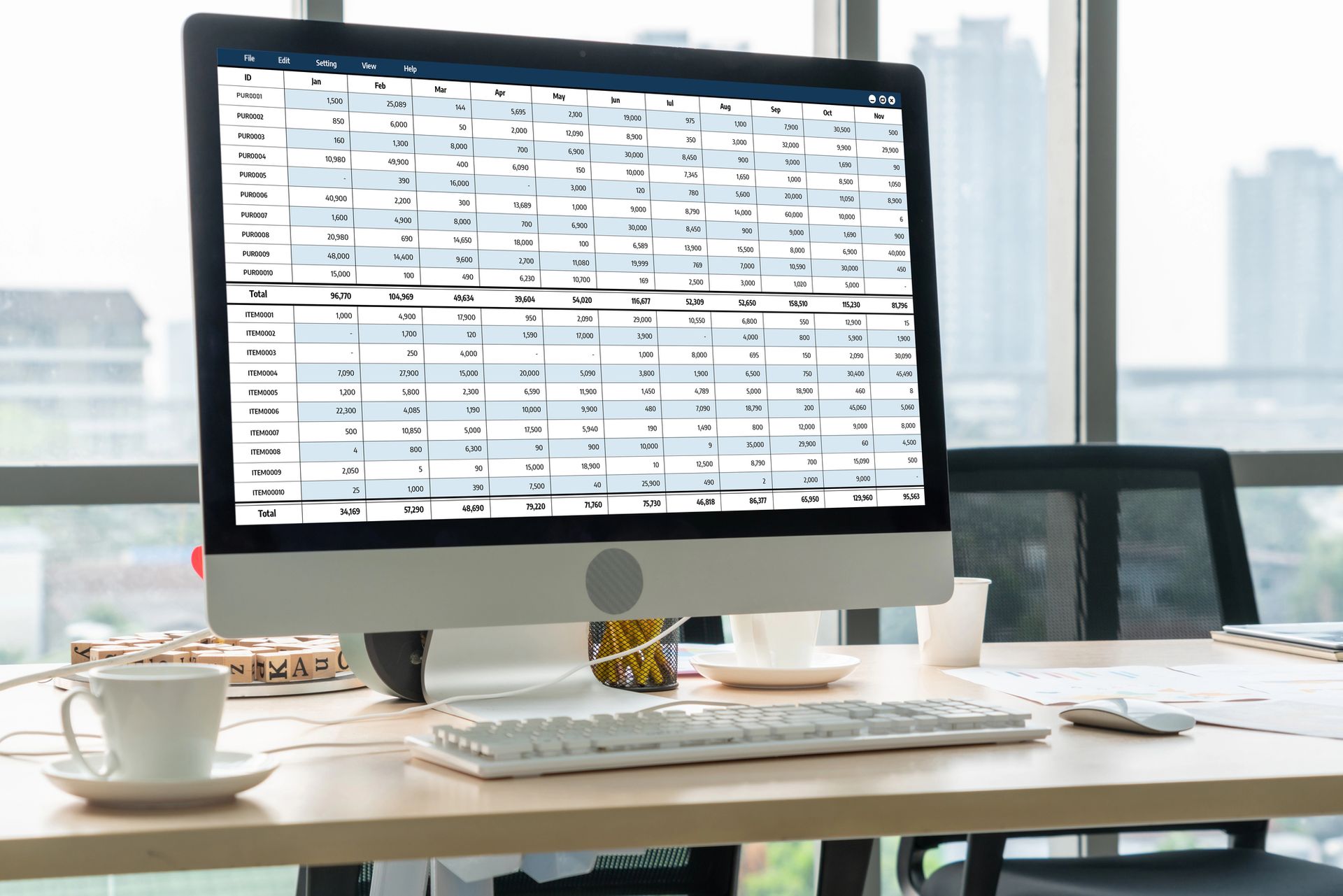

You may be aware that HMRC are in the process of moving towards a more digital method of delivering self-assessment returns. It is likely that in the future, taxpayers will be required to maintain digital records of their income for each tax year. This will be likely to take the form of a list of transactions either in a spreadsheet or in bookkeeping software. Submissions to HMRC will then be made to HMRC on a quarterly basis via software with an annual adjustment to bring the year to a closing position.

As it stands at the moment, this will be starting for some taxpayers from April 2024, starting with sole traders and landlords with income over £10,000. Full guidance is not yet available, and our processes will be updated as and when we have a better understanding of what the requirements are likely to be and when they come into play.

If you have any questions regarding your self-assessment return, use the button below to book a call with Laura.