10 reasons I love my job...

I know, I know…accountants are boring! The thing is, I really like my job (especially now that I am working independently). Here is why!

1.I’ve always enjoyed numbers and problems, from school right the way through to the University of Glasgow where I gained my degree in Maths. That said, I will still resort to either spreadsheets or my trusty old calculator (bought in 1999 when I was taking my CA exams) to double check all my sums!

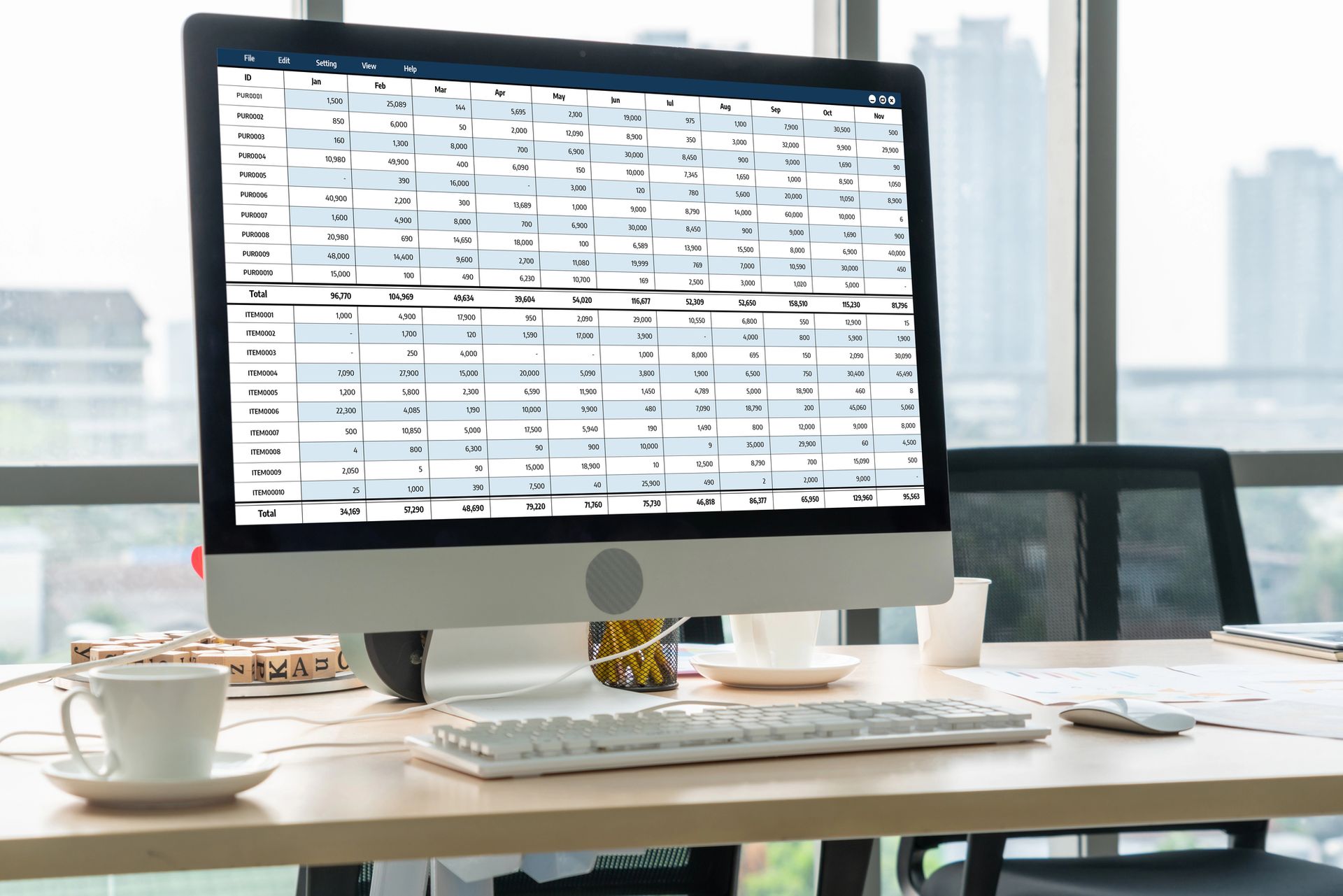

2.I love spreadsheets. Excel is such a powerful tool and I think most people (myself included) only scratch the surface of what it is really capable of. I genuinely enjoy taking your financial data and transforming it into something that is going to be both useful in your business and satisfy your reporting obligations. For very small businesses, an Excel spreadsheet is more than adequate to meet these needs.

3.I get to help people. Whether you approach me when you start struggling with the tax requirements or whether you contact me long before it gets tricky, I love that I can help you navigate through the difficulties and provide you with that sense of relief that things are being taken care of.

4.I feel a great sense of satisfaction when I manage to reduce people’s tax bills or even get a tax rebate for them.

5.Whist I enjoy transforming data with Excel, for larger businesses I also enjoy bookkeeping. Bookkeeping software can really transform a business, helping you maintain up to the minute data and bringing order to what to some may feel like chaos. The reporting suite of a good bookkeeping software can also help support you in making the right business decisions to help take your business forward.

6.I find the work interesting and varied. Every business is different, and everyone has their own way of operating. Whilst I come across similar issues across different businesses, each piece of work that I take on is tailored to the individual business involved.

7.My business networking has allowed me to develop a great network of local people that I know that can supply me with services to support both my business and my personal life. Who wouldn’t enjoy meeting up with existing contacts and new people over a cup of coffee.

8.All it took for me to start my own business was a little bravery and a lot of experience as an accountant. I am even lucky enough to work from home, so my daily commute is negligible!

9.There’s no shortage of things related to my day to day work to learn – the tax world is always changing according to the government’s latest focus.

10.There’s no shortage of other business skills for me to learn about. As I am a sole practitioner, I am responsible for all aspects of my business’s growth and development. Since starting up I have learnt business skills relating to design, marketing and sales, to name but a few.

I am lucky that I have a job that I really enjoy. If you think I can help you by doing some of the work that you hate, get in touch with me using the contact form below. If you’ve enjoyed reading this article and would like to hear more stories like this one, sign up to have my latest blog posts delivered direct to you inbox here.