Contracting through a company – an overview of IR35

What on Earth is IR35 and what do I do about it?

IR35 comes into play where an end user contracts to have work done (often through an agency) and the person that completes the work operates through a small limited company owned by the worker. The end user pays the company and the company pays the worker. IR35 looks at this situation and ignores all the components of the chain and asks whether the worker is in substance working as an employee.

If the contract does operate as if the worker is an employee, then the contract falls within the requirements of IR35. The income is taxed as if the worker were an employee by reducing the turnover by 5% to take account of expenses and deducting pension contributions to work out a gross wage. This gross wage is then taxed as if it were a salary.

If the contract is outside of IR35, the worker generally chooses to pay themselves a low amount of salary with a relatively high proportion of reward coming in the form of dividends. Dividends attract a lower rate of tax and no national insurance contributions. It’s worth remembering that although the rate of tax on dividends is relatively low, they are paid after the deduction of 19% corporation tax, so the rate is not as beneficial as it first looks. See my dividend blog post for more information.

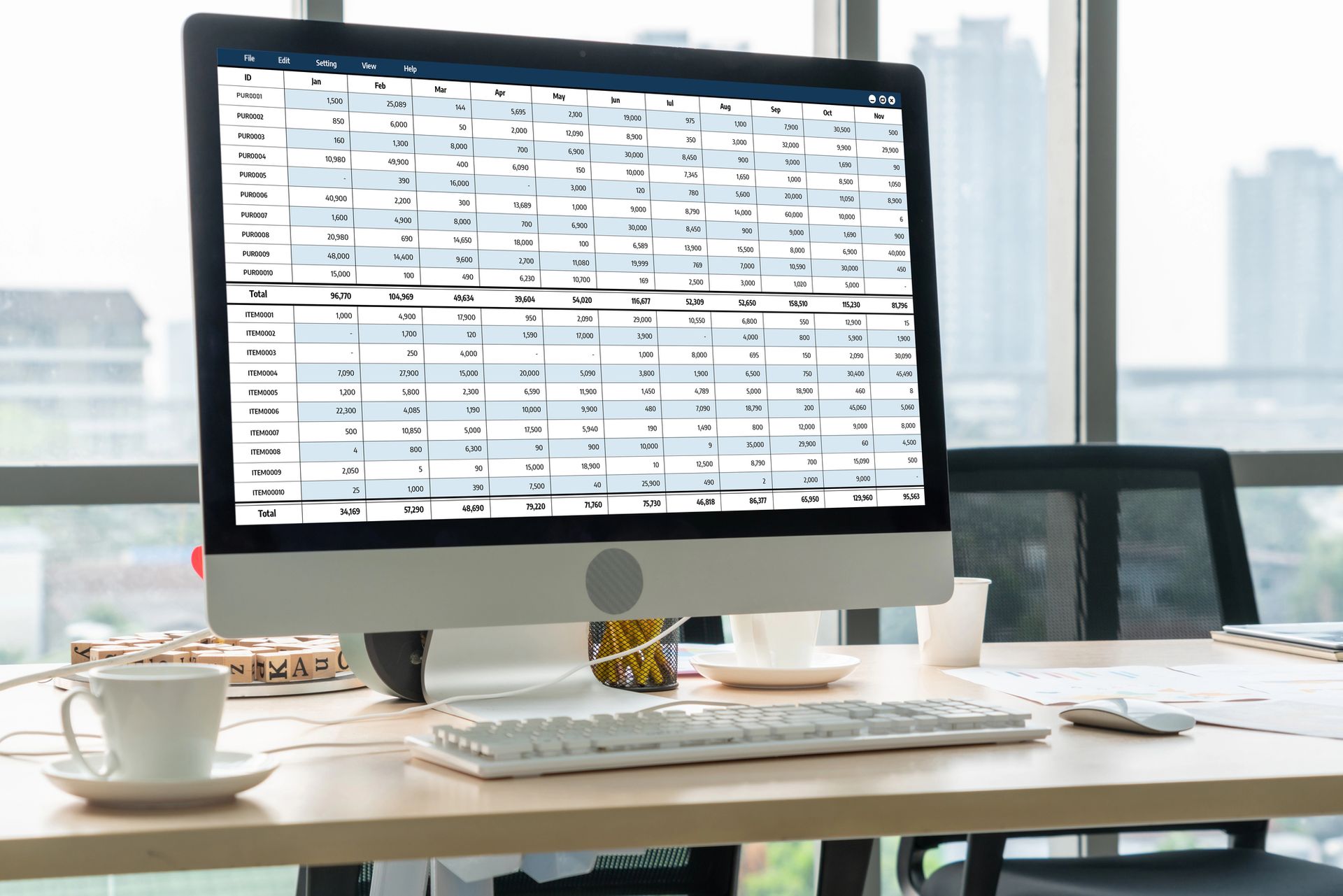

As it stands at the moment, it is the contractor that decides whether they are inside or not so and bears the risk of getting that decision wrong. If HMRC challenge your employment status you may need to account for additional tax and national insurance on your income. The chart below shows the relative take home pay after tax when a contract with income of £96,000 falls within or outside IR35 (note that every contract is different and the percentages of tax paid are different at each income level and where a different ratio of salary and dividend is selected).How do I decide whether my contract falls under IR35?

There are 4 main attributes that define whether a contract falls under IR35 or not.

·Mutuality of obligation – are you obliged to work for the end user and the end user is obliged to continue to offer your company work?

·Control – does the end user dictate how the work is to be completed?

·Substitution – are you prohibited from sending a different worker within their company to complete the job?

·Financial Risk – if errors are made, would the company still be paid whilst correcting the problem?

These questions don’t cover the whole picture but if the answers to all of these questions is yes, then the contract probably falls under IR35.

There is an online tool hereto help you decide whether you are a worker or an employee, but it doesn’t take account of mutuality of obligation as this concept is difficult to define. Use it and print the results to keep as evidence that you are outside IR35.

What is changing?

In 2019, the Government will be consulting on changes to the IR35 regime due to come into force in April 2020. It is expected that the main changes will be that the end user will be required to make the decision on whether or not you are an employee or a contractor under IR35. This change has already been implemented for contracts in the public sector and after the consultation is complete, similar changes are being rolled out to the private sector. The new rules haven’t yet been set into law yet but we now have a clearer idea how they will operate and you can find out more here.

IR35 is a complex area because of the subjective nature of deciding whether the IR35 rules apply to your contract. Make sure you maintain your evidence that supports your contractor status. If you’d like to stay up to date with the latest changes and what they mean for you, subscribe below to receive my latest blog posts direct to your inbox.