What does a company secretary do and do I need to appoint one?

Laura Arbuckle • December 6, 2019

What does the company secretary do?

When you set up a company it is no longer a legal requirement appoint a company secretary, but it is something that you should consider.

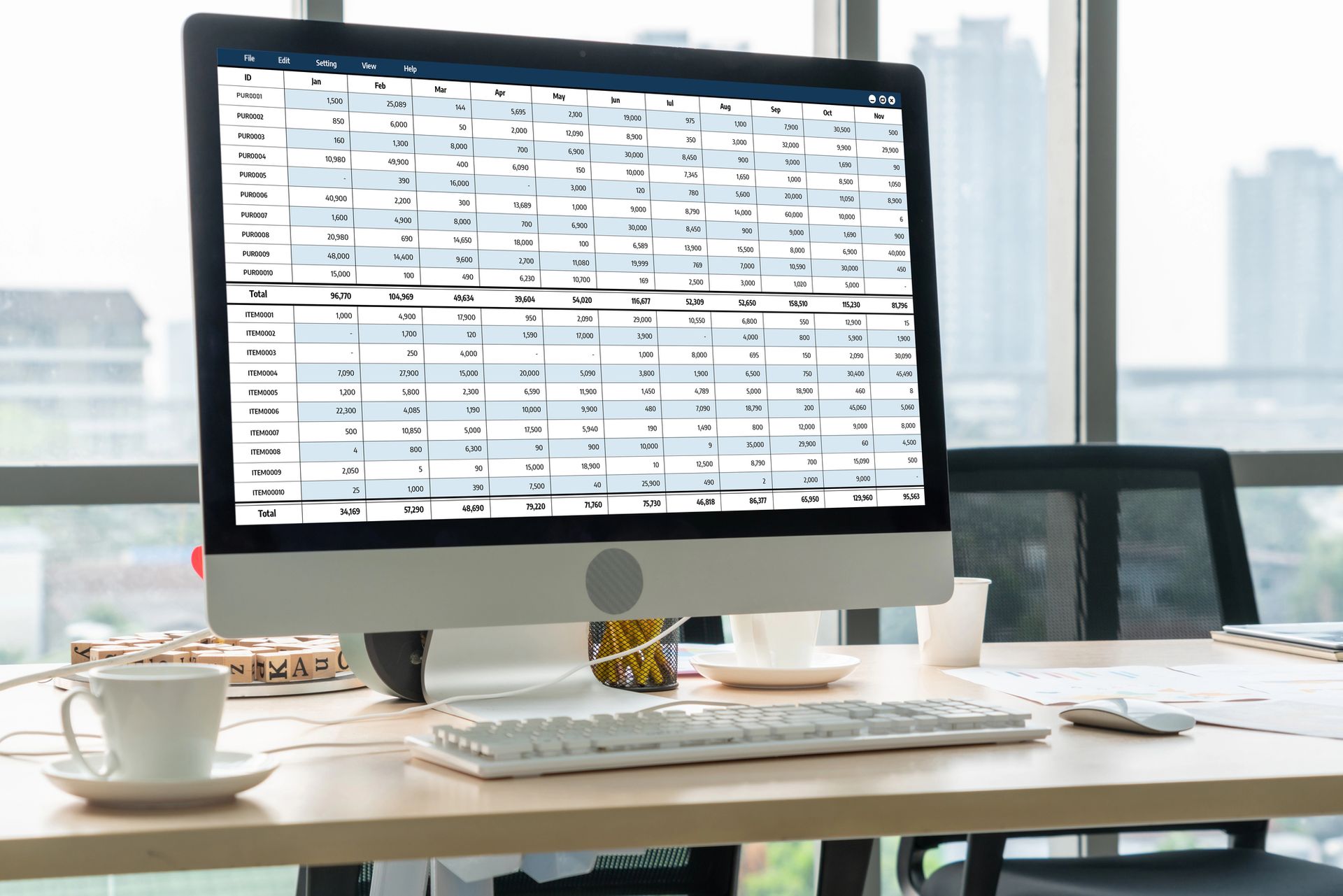

The company secretary role for a small company tends to be that of ensuring that all the company administration work is kept up to date. The main tasks include maintaining the statutory books and records of the company and often the company secretary signs off the balance sheet.

In large public companies the role is generally filled by someone with a legal background that understands the legal requirements of such large companies. In a smaller company a legal background certainly isn't a necessity.

Do I need a company secretary?

It's not something we ever want to think about, but I have occasionally been forced to have conversations with a few of my clients about the potential for their illness or death. If you are the sole director and shareholder of your company, it is worth taking the time to have a think about what might happen if you are no longer able to manage your company.

Even if you are aren’t there, the company will still have to meet all the requirements of Companies House and HMRC. There may also be financial commitments or significant assets within the company that need to be dealt with. If these requirements or commitments cannot be met, it can create financial or legal challenges, not to mention distress for surviving family members.

The circumstances that prevent you from managing the company will dictate who will subsequently need to fulfil the necessary requirements. It may fall to the shareholders to appoint a further director in order to make company decisions. However, in the event of your death where you haven’t made a will there may be legalities that make it difficult to determine who inherits the shares and therefore who the new shareholders are. With a company secretary in position, they can immediately appoint a new director despite the lack of shareholders, keeping the company operational.

Can I pay my company secretary a salary?

The secretary role can be a paid role, although it doesn't have to be. If you are paying family members a salary from your company, the amount paid should be in line with the services performed. Being the company secretary and having the responsibility that comes with that role adds credence to any salary payments made.

Who should I choose to appoint as my company secretary?

In addition to having additional people able to operate your company in your absence, you should also make sure that the individual you choose knows how to perform this role should they need to. Here

is a link to last week's blog that discussed the types of administrative information that you need to keep safe and accessible so that you can operate your company. Your delegate should also know where to find this information should they need it.

It would be an advantage (although not a necessity) to have someone capable and well organised enough to be able to navigate the requirements of HMRC and Companies House, although your company’s accountant should be able to guide you or your company secretary through any administrative hurdles as they arise.

As well as giving them access to the workings of the company, if you are able to find someone you trust enough, you may also consider granting them some sort of access to the bank account in order that they can continue to make company payments if needed.

Being the sole director for a company can also be a lonely business. You might also consider appointing a company secretary that can take a more active role in the business and act as a sounding board for you when it comes to making those difficult decisions.

Given the importance of the responsibilities that you are about to hand over, you really to make sure that the person you appoint as company secretary is someone you trust to make the right decisions and hand back the reigns when you are able to take over. If your relationship with that person changes, you may need to act quickly to remove their appointment.

Here

is a short blog from Companies House describing how to keep the company operational in the event of the sole director’s death. It mentions that personal representatives of the director can appoint a new director to take over the running of the company. This may take time to put in place and by having someone else involved with your company already can take the pressure off them at what can already be a difficult time.

Hopefully there will never be any need for the company secretary to step up in your company but it's a good idea to be prepared, just in case.

If your company provides you with a traditionally fuelled car for personal use, it can be a very expensive way to fund your vehicle. However, if your company provides you with an electric car that you can use personally instead, the tax tends to be substantially lower than for traditional vehicles and there are incentives for the company as well.

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.