How will I comply with HMRC's Making Tax Digital requirements?

What do I need to do to comply with making tax digital?

Big changes are coming to the way that sole traders and landlords will submit their self-assessment returns to HMRC, starting from April 2026. The government believe that by requiring business owners to keep their business records digitally, business owners will benefit from more up to date information and the government will also benefit from gathering more accurate data more regularly. Time will tell what the benefits are to either party but the regulations are coming and if you are in the first wave of participants, you need to act now.

Its worth noting here that this does not apply to companies or partnerships.

What am I required to do to comply with Making Tax Digital?

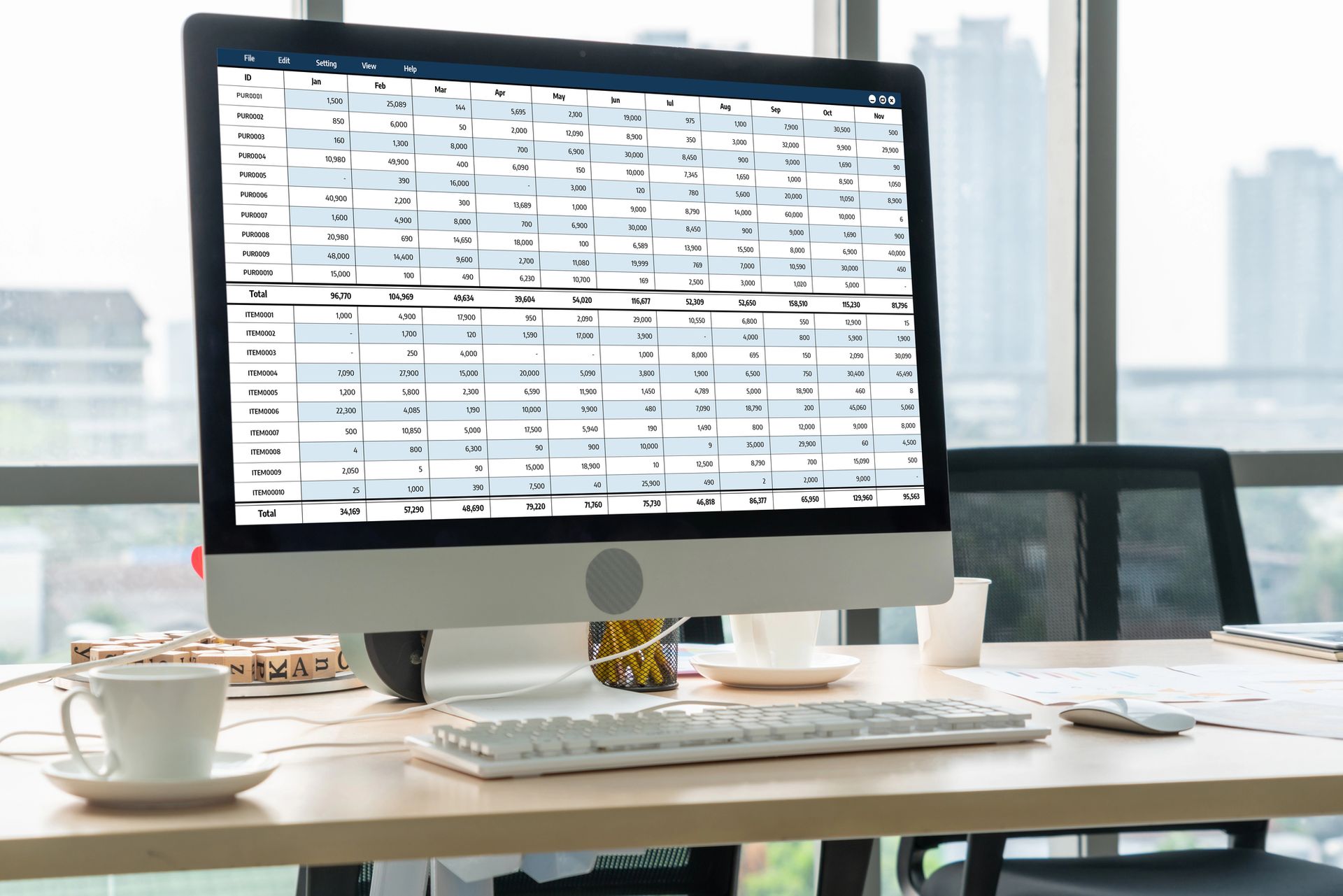

There are obviously more detailed rules but essentially, when Making Tax Digital becomes mandatory for you, you will be required to keep your business records in a digital format. The way in which you do this could involve bookkeeping software or it could be a spreadsheet but you will be required to use digital means. In any case, for each transaction (or you can post daily totals) you need to keep a record of the date, a description and the amount of the transaction.

HMRC will require you to evidence that you have done this via quarterly submissions to them from specially designed software that can connect to HMRC systems. The deadlines for these submissions will be 7 August, 7 November, 7 February and 7 May for quarters to 30 June/5 July, 30 September/5 October, 31 December/5 January and 31 March/5 April respectively.

How will I manage to comply with Making Tax Digital?

Your basic Making Tax Digital plan for a simple business is summarised below. You can use spreadsheets to manage your business but you would need connecting software (called bridging software) to be able to make your submissions if you decide against using bookkeeping software. Bear in mind that you will need to create separate submissions for each business that you operate so if you have a business and are also a landlord, you may have two separate submissions to make.

- If you don't already have a separate bank account for your business, this will become almost essential once you have to start making digital submissions to HMRC. It doesn't necessarily need to be a business account, just separated from your day to day personal account.

- Once you have your chosen bank account set up, make sure you receive all sales income into that bank account. Bank any cash you receive.

- Use that same bank account for all your business payments and only business payments.

- Make regular drawings from your business bank account into your personal account for personal spending.

- Connect your bank account to your bookkeeping software and post the transactions to the correct categories as you go along.

- Make your quarterly submissions to HMRC by the deadline directly from your bookkeeping software.

Obviously not all businesses are as straightforward so you may need to add the following tweaks to this simple outline.

- You may choose to use your bookkeeping software to send your invoices.

- If you receive and spend a lot of cash, you may need to keep your own (digital) "bank" statement noting date, description and amount each time you spend or receive cash payments. You can then upload this as if it is a separate account to your bookkeeping software.

- If you use a second business account you need to be very careful to mark any transfers between accounts as such, rather than your transfers inflating your sales.

- If you use a credit card provider or third party payment app, you may need to upload their charges to ensure you include the gross sales in your records.

- You could add receipt capture software to help you manage your expenses (and to a lesser extent your income if you are not invoicing from your bookkeeping software)

- You may need a separate software licence if you have to report more than one business.

When does Making Tax Digital happen for me?

HMRC are using your 2024/25 tax return to decide when you will be required to comply with Making Tax Digital. Taxpayers will be required to comply with Making Tax Digital in stages depending on their turnover.

Turnover greater than £50,000

You will be required to comply with Making Tax Digital Regulations from 1 April 2026.

Turnover under £50,000 but over £30,000

You will be required to comply with Making Tax Digital Regulations from 1 April 2027.

Turnover under £30,000 but over £20,000

You will be required to comply with Making Tax Digital Regulations from 1 April 2028.

Turnover Under £20,000

Making Tax Digital is not currently required but watch this space!

What should I do now?

The first thing that you need to do is to get your 2024/25 self-assessment return drafted and submitted so you know when you are likely to be required to comply with Making Tax Digital.

If you know you will be in Making Tax Digital you can opt to join early, which would give you a feel for the submissions before they become mandatory. There are no penalties during the trial period. If you would like to join the trial, talk to your accountant to see if it is a reasonable option for you.

If you are VAT registered, you may wish to adjust your VAT quarter ends to align with the submissions for Making Tax Digital as the review work for one would likely reduce the review work for the other, especially if you use the cash basis for VAT.

I have outlined a plan above to get you onto bookkeeping software. Does it work for you? If so, work towards setting your business up so as to make the reporting as straight forward as possible. Speak to your bookkeeper or accountant to find out what their plan is for dealing with the new reporting requirements.

If you would like to take care of things yourself, this HMRC link will help you find suitable software that will help you comply with the requirements.