Can my company provide health insurance for me?

I started trying to write this blog post in quite a broad manner to cover all possible benefits that your company may provide for you. However, I quickly realised that given all the complexities that surround benefits in kind it would be more helpful to talk about the specific example of health care costs that a couple of people have asked me about recently. If you have a specific benefit in mind that you would like me to run through, please get in touch. Remember that everyone’s tax position is different and if you want to tailor this for your own circumstances, you should speak to your own accountant or you can give me a call.

Your company can refund your business expenses if they are wholly, exclusively and necessarily for the trade but what if your company provides you with something that doesn’t fall into this category? If it isn't an expense of the business, it would generally form part of your salary and be taxable. Whilst there are a few examples of benefits that can be provided to employees free of tax, national insurance or both they are few and far between. The provision of childcare, certain healthcare benefits and provision of a mobile phone all fall into this category, but even these things are only exempt from tax if they meet certain criteria.

There are some health care costs that the company can provide for their employees without them becoming a benefit in kind. These include annual health checks, some eye tests, treatment for employees working abroad, treatment for health issues arising because of work and treatment to help an employee return to work.

The payment of health insurance premiums for you or your employees is a benefit in kind and would therefore be taxable in the hands of the employee and the company also has to pay national insurance on the premiums.

And so, to finally answer the question...yes, your company can buy health insurance for you but sometimes it works out cheaper overall for you to be paid more so that you can arrange it yourself! It depends on what your income level is and how your income is extracted from your company. Never a straight answer when it comes to tax, is it?!

So, what are the options?

1.Pay the premiums yourself

If you pay the premiums yourself, no benefit in kind arises, but you would pay the premiums out of your net income. If you take additional salary to pay these premiums, you will pay tax and national insurance and if you are meeting these premiums by declaring a dividend then the company will incur corporation tax before the dividend can be paid and you will also incur income tax on the dividend. The rate at which your salary or dividend is taxed depends if you are a higher rate taxpayer or not.

2.Company arranges the insurance and pays the premiums

The company pays the premiums and you receive a benefit in kind. The payments are allowable as a deduction for corporation tax, but you are taxed at your prevailing income tax rate and the company incurs additional national insurance. There is no employees national insurance on a benefit in kind.

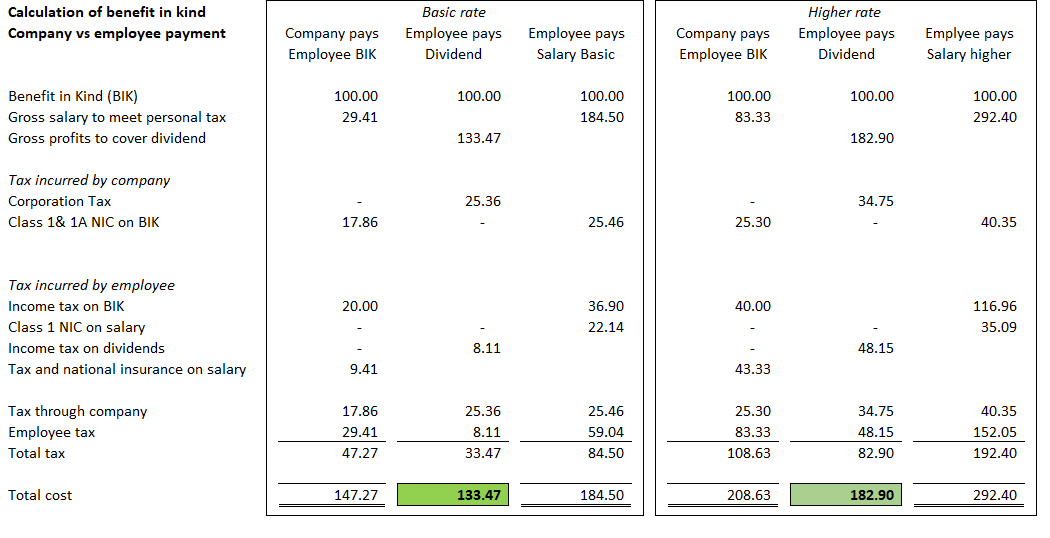

Consider the example of £100 of health insurance premiums paid in the year, shown in the table below. I have compared the overall cost of the company providing the benefit to the overall cost if you pay the premiums yourself.

If dividends are a route open to you, the overall cost of providing the benefit is lower if the company declares a dividend and that payment is used to pay the insurance premiums. If dividends aren’t an option, the total cost is lower if the company pays the premiums because there is no national insurance paid on your benefit in kind. This is still considerably better than being paid a salary to pay the premiums personally because of the saving in employees national insurance contributions.

If the company does pay your premiums for you, or if you receive a different benefit in kind not discussed here, it either needs to be reported through your payroll or on a P11D at the end of the year. P11Ds need to be with HMRC by 6 July each year and to report it through your payroll you need to have registered before the start of the tax year in question.

If you would like to discuss the optimum way of providing these benefits to you or your employees, please get in touch with me using the buttons below.