Why should I measure statistics about my business?

Laura Arbuckle • November 22, 2019

In common with many of us, up until a few months ago I was using a fitness watch to measure my daily steps, sleep pattern and exercise. Unfortunately, the watch strap broke and I couldn’t wear it anymore. I had a quick look online and couldn’t see a new strap that I could easily order and after that it slipped my mind.

On thinking about Christmas presents, my husband decided he would replace the strap for me and he found one for only a few pounds so he decided to give it to me early so that I could get the use of it again.

A few weeks ago I wrote about losing my motivation to go swimming. When I got back in the pool this week with my fitness watch back on my wrist I realised that one of the things that had perhaps contributed to my malaise was that I had stopped measuring my progress.

I was reminded that measuring performance is a good thing to do because it helps you to focus on the things that really matter. Not only that, it can help you to recognise the small victories that can club together to become even bigger wins.

There are lots of different key performance indicators (KPIs) that you could be measuring to help ensure that your business remains on track. This is a selection of things that you may find useful to track over time, but there are loads more – and you can even create your own.

Check your bank balance daily

Having enough cash to keep going is important in any business. I check my bank balance every morning and I know that each month I am working towards the amount I need to have available to pay all my expenses as they fall due. If my bank balance is looking a little low, I can take steps to improve the position.

Having a business plan can also allow you to look ahead to where your cash position might be in the future, allowing you to pinpoint any future period where the business might be at risk of running out of cash.

Review your profit monthly

My business is still growing and I check my profit at the end of each month as a minimum to ensure it keeps going the way I want it to. I compare the profit each month to my financial plan to see if I am on track.

By measuring, I keep my focus on the things that I can do to improve the position if need be. It’s also a chance to spot patterns in the turnover of the business, such as seasonality. If I can identify quieter periods I can work out why they happen and make sure that I put funds aside to keep my business moving.

How much invoiced income has yet to be received?

One of the most frustrating things for small businesses is not getting paid quickly enough whilst having to pay your own debts up front. This can place a lot of pressure on the cashflow of the business, which (if not managed successfully) can cause real difficulties for any enterprise. Monitoring the size of the debtor balance regularly can help you to focus on any necessary corrective action in order to avoid any issues with your bank, or other creditors.

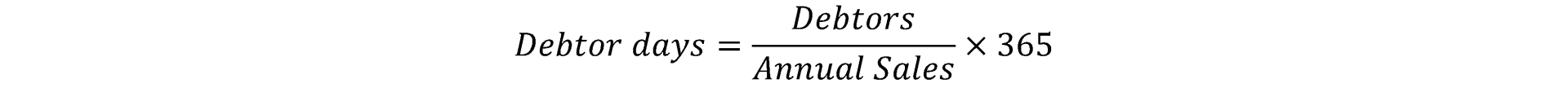

The debtor days ratio is a common measurement used to express the number of days of income that is tied up in debtors – put simply, if you allow your debtors 30 days to settle their dues, you would expect your debtor days ratio to be no higher than 30.

Keeping a consistently low debtor days ratio is a good sign your debtors are adhering to the terms you have set out.

Check your marketing statistics

If you are focused on growing your business, then it is a good idea to measure the things that you are doing to market your business. What you decide to measure depends on the marketing strategy you are employing in your business but is likely to include some non-financial information.

Again, the act of measuring focusses your attention on the numbers that matter to you, helping you to identify successes and failures. Identifying the things that are not working is as useful as identifying the things that are.

My own marketing efforts are based on content marketing. The things that I measure on a monthly basis are therefore based around the content that I share in order to attract new customers. Numbers of website visitors, social media followers and number of new clients in a given month are amongst the things that I record and look for trends.

There are many things that you could measure that will help you keep tabs on how your business is doing. What you decide to measure should be tailored to your own business and to your particular focus or priorities, given where you are in your business’s lifecycle.

I’m really pleased to have my watch back. At a very basic level it means I don’t have to count my laps of the pool anymore! And if I want to analyse the statistics further, I can work out know whether I have exercised enough to justify that piece of cake I have my eye on.

If you’d like to understand more about what statistics mean for your business, give me a call.

If your company provides you with a traditionally fuelled car for personal use, it can be a very expensive way to fund your vehicle. However, if your company provides you with an electric car that you can use personally instead, the tax tends to be substantially lower than for traditional vehicles and there are incentives for the company as well.

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.