Does the reduction in the VAT rate apply to my business?

Laura Arbuckle • July 15, 2020

Last week the Chancellor announced a temporary reduction in the VAT rate for hospitality, holidays and attractions in order to try and encourage consumers to spend their money and help get small businesses back on their feet again.

Which supplies are affected?

The reduced rate applies to food and non-alcoholic drinks sold for consumption on premises, hot takeaway food (cold takeaway food and drinks are zero rated) and non-alcoholic beverages, sleeping accommodation and entry fees for some attractions. You can find the full list in the guidance here.

When do I need to charge the reduced rate?

The reduced rate of 5% kicks in from 15 July 2020 and will remain in place until 12 January 2021. If date of supply falls between these dates you should apply the reduced rate. After 12 January 2021 the rate will revert back to the standard rate of 20%.

When the supply takes place depends on whether you are supplying goods or a service. For goods, the time of supply is the point at which the goods are sent, collected or made available. For services, the time of supply is when the service is completed.

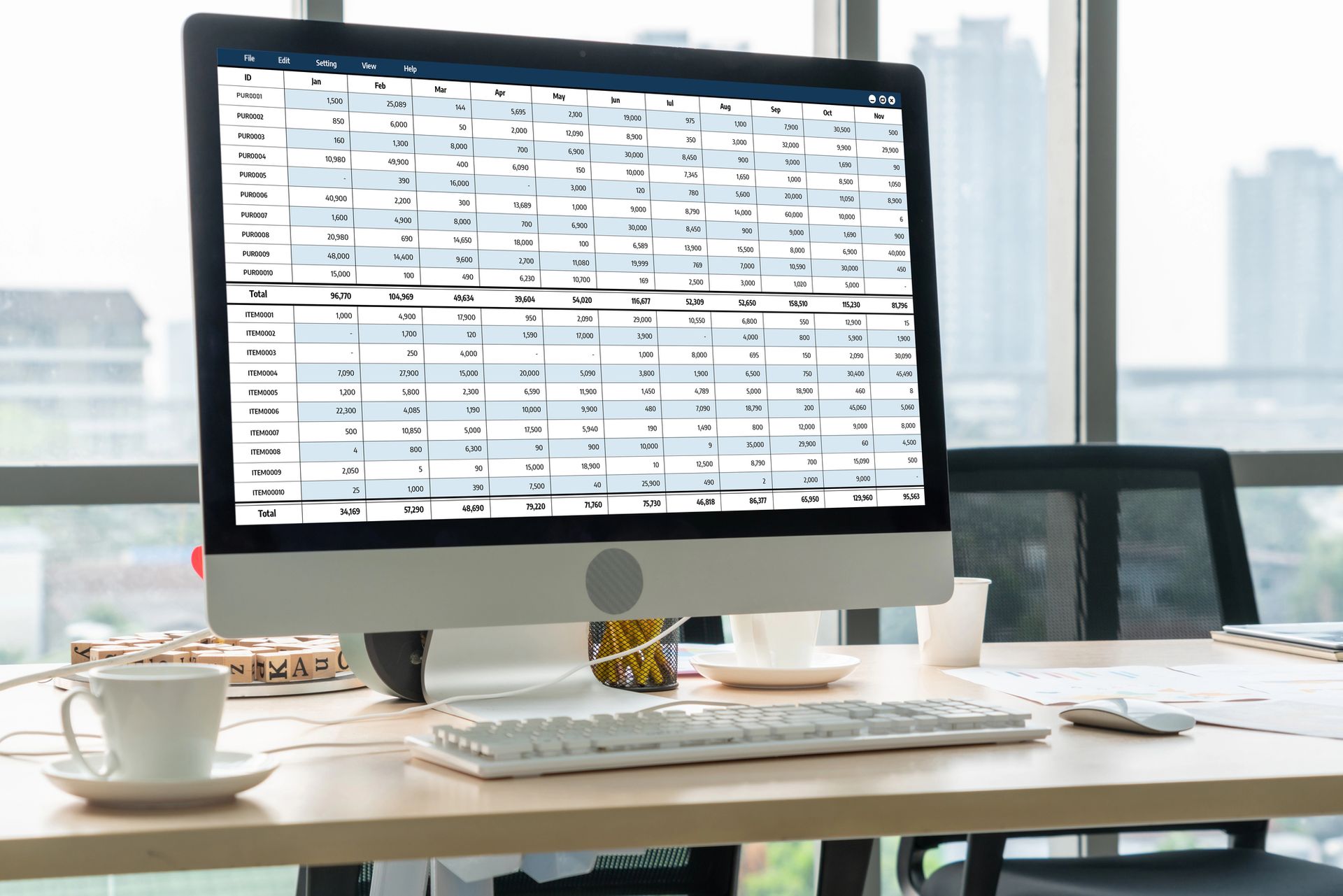

How do I record the reduced rate?

The reduced rate of 5% is already in use for women’s sanitary products and some energy bills so your bookkeeping software should already have the reduced rate available to use. All you need to do is select the appropriate rate when invoicing.

If you use am electronic point of sale system, you should be able to adjust the rate of VAT charged by product to ensure the correct rates are used.

If your company provides you with a traditionally fuelled car for personal use, it can be a very expensive way to fund your vehicle. However, if your company provides you with an electric car that you can use personally instead, the tax tends to be substantially lower than for traditional vehicles and there are incentives for the company as well.

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.