What changes are happening for contractors?

Expected changes to off-payroll working working rules

If you are currently acting as a contractor through your own limited company you may be aware of the changes that are expected to come into force from 6 April 2020. Although not completely pinned down into law yet, we now have a reasonable idea as to how the new rules are likely to be operated.

Does this apply to my contract?

The first thing to think about is whether the changes will apply to you. If you are serving a contract with a small business , then the existing regulations will continue to apply and you remain responsible for deciding whether your contract falls under the off-payroll working rules. You can find out more about the current rules for making such a determination here and these rules aren’t changing. Otherwise, the new regulations will apply to you.

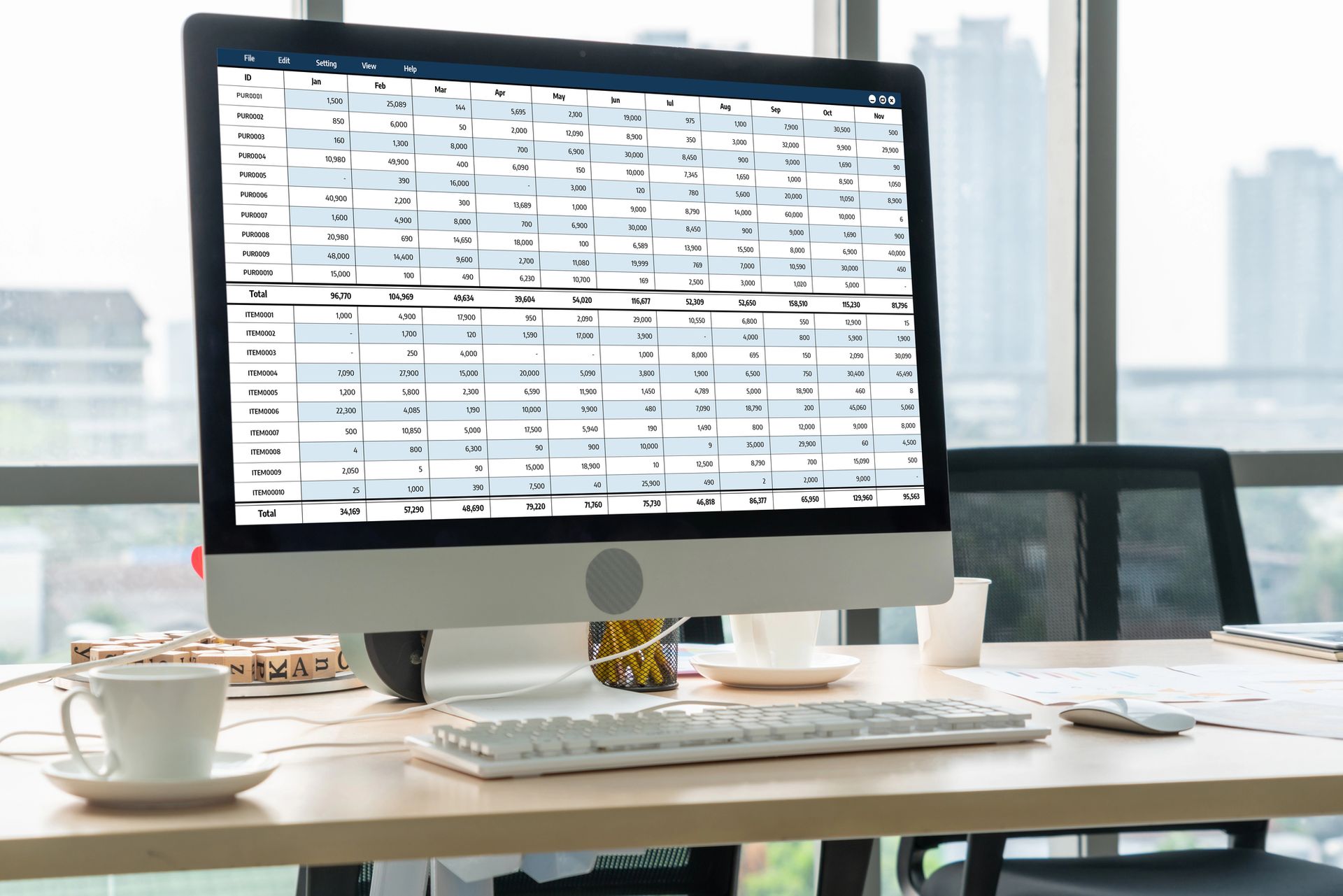

A company is considered a small business if it meets two of the following three conditions. For sole-traders and partnerships, only the first of these conditions applies.

- Annual turnover of less than £10.2 million

- Balance sheet total under £5.1 million

- Fewer than 50 employees

What happens if the changes apply to me?

Under the existing rules, you are responsible for determining your own employment status for each contract your company is involved in. As noted above, the rules for determining that status can be found here and they are not changing.

What is changing is that responsibility for deciding whether your contract falls under the off-payroll working rules or not will move from your company to your client. The client that has engaged your services will write to you to tell you whether your contract has been deemed an employment and the reasons behind this determination. The client is also responsible for communicating the status determination to any intermediary that is involved in hiring you. If your contract is deemed to be an employment, then Income Tax and National Insurance contributions (NICs) will be deducted from any income you receive in the performance of duties.

You can appeal this decision by writing to your client, setting out the employment status determination and your reasons for disagreeing with it. The client has 45 days to respond, however in the intervening time they will continue to deduct Income Tax and NICs from any payments made.

What income will I receive if my contract falls under the off-payroll working rules?

Instead of receiving your payments gross from your client, your client (or the agency) will deduct Income Tax and NICs from your income and pass this to HMRC. If your company receives payments that have had Income Tax and NICs deducted, you should not deduct tax again when you pay your company’s employees. Your client will also be expected to account for employers’ National Insurance. Be aware, this change will make your contract more expensive to your client so they may try to reduce your rate of pay to accommodate this additional cost to them should your contract fall within the revised rules.

The agency is not responsible for statutory payments such as sick pay or maternity pay, student loan repayments, automatic enrolment or holiday pay. This responsibility will remain with your company where applicable.

Should I continue to work if my contract falls under the off-payroll working rules?

If your contract is determined to be treated as an employment for tax purposes, you may wish to reconsider the structure of such an “employment”. Employees generally pay more tax than contractors in return for additional rights that contractors don’t receive the benefit of (including but not limited to holiday pay, sick pay and pension contributions). If you are taxed as an employee, you may prefer to work as an employee so as to gain access to these workers rights.

Remember however that each contract is assessed on a standalone basis so if your existing contract is deemed to fall under the off-payroll working rules you may be able to find another contract that isn’t deemed to be an employment.

It remains to be seen whether private companies move towards employing people directly or continue to engage contractors. In any case, as a contractor it is going to be essential to maintain communication with your client and your accountant in the run up to 6 April 2020.