What do I do now?

Laura Arbuckle • March 19, 2020

I don't know about you but, I’m feeling terrified…terrified but fascinated at the same time. We are living through a time of so much uncertainty and I don’t know what to do about it. So, I’m doing the only thing I can do, which is to keep going. I’m going to keep putting one foot in front of the other, making one decision at a time and eventually I will make it through this difficult period somehow.

In the meantime, the government is trying to help and there are some practical things you can do to try and keep things going for as long as possible. You can find a link to the government announcements here.

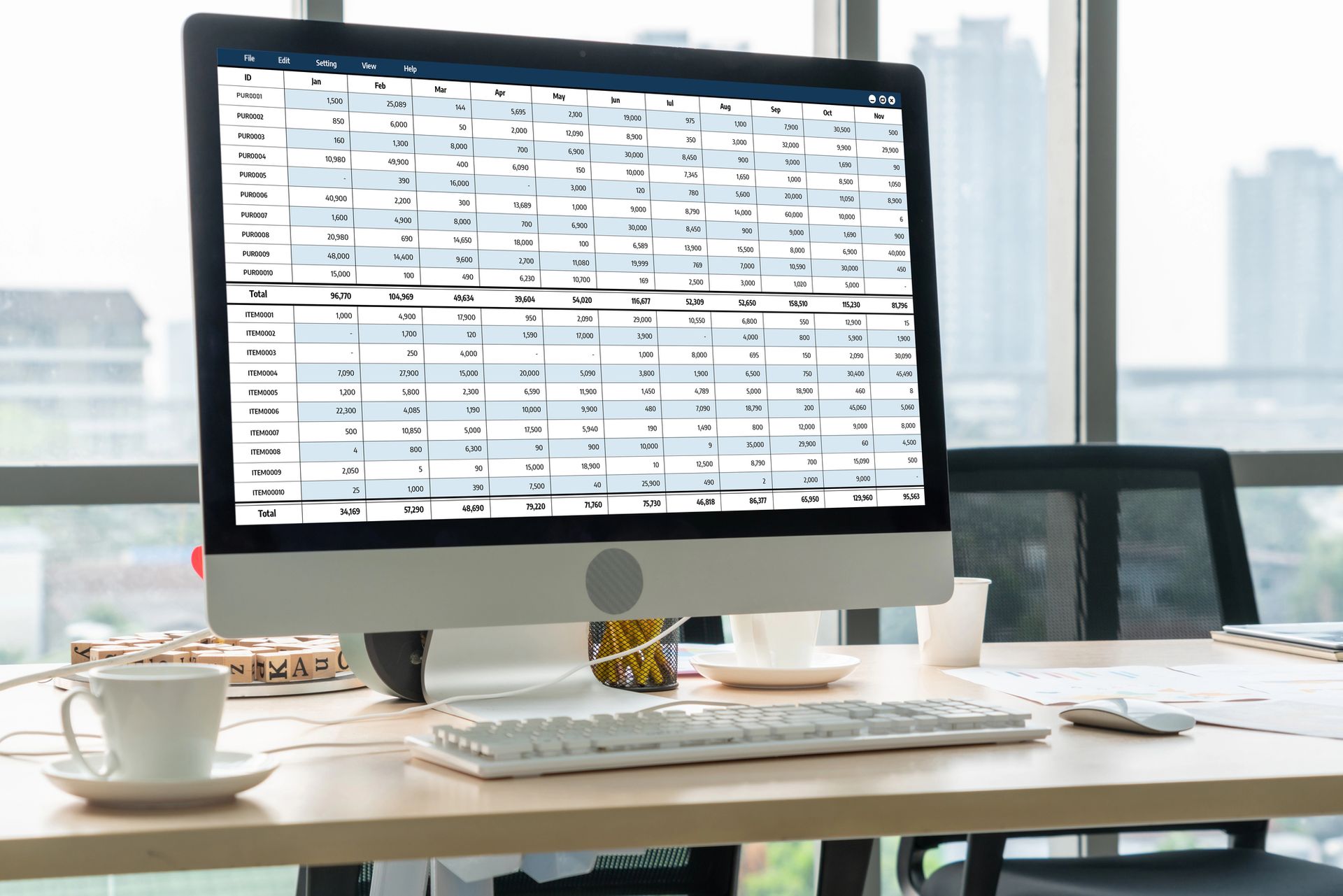

Maximise your cashflow

Speak to your customers, especially those to whom you have extended credit terms. You need to know whether they can make their payments earlier or whether they will be able to make them at all. Whether it’s good news or bad, the information can be used to make decisions for your own business.

Speak to all your suppliers and see whether there is any leeway to reduce your payments or even pay over a longer period of time. Remember that they may be struggling financially and grappling with difficult decisions themselves.

Make sure you cancel payments for anything that you are not actively using. This is a good time to review your costs generally to see if any savings can be made.

What help is available to my business?

The government is releasing loan funding to small businesses in the coming weeks. The details aren’t yet available, but it is expected that the government will offer guarantees for up to 80% of a business loan, which will assist with obtaining funding. Bear in mind this would be in the form of a loan and it would still need to be repaid in the future. You should only take on a loan if you can afford the repayments.

If you have money due to HMRC and you don’t expect that you will be able to make the payment, it is worth speaking to their Time to Pay team to arrange longer to make your payments. You can see my blog post here

for details. Bear in mind that they are likely to be overwhelmed with calls and you may have to wait to get through. Don’t leave it too close to the deadline as the agreement needs to be in place to avoid a penalty.

If you have business premises that are under the small business rates relief threshold, you may also be able to benefit from a one-off grant of up to £10,000 to help with ongoing business costs. If you are eligible, your local authority should contact you directly. The funds won't be available until early April. Larger businesses in the hospitality, leisure and retail industries will receive a business rates holiday for the whole of 2020/21 and/or may be entitled to grants of up to £25,000.

Also, check the terms of your insurance to see if you are eligible for any assistance.

What help is available to me?

If you are a director of a company, you may be entitled to Statutory Sick Pay if you are unwell. The company is usually responsible for paying this, but the government are now reimbursing up to 2 weeks Statutory Sick Pay from the first day of illness.

If you are self-employed or don’t earn enough to be eligible for statutory sick pay, you may be able to claim Employment and Support Allowance here.

Reception to Universal Credit has not positive over the last few years since its introduction but it may be worth considering applying for it now, especially if you have lost or reduced your income significantly as a result of the Coronavirus epidemic. There are restrictions but you can take a look at eligibility and apply here.

If you own your own home, you may be able to get a three-month mortgage payment holiday. The interest on your mortgage will continue to accrue if you don’t make your usual payments but this would improve your cashflow in the short term. If you are renting, you should speak to your landlord about postponing rent payments if your funds run low.

Of course, if we are all unable to leave the house our living costs will also reduce. We won’t be spending money on travel, meals out or any of those little luxuries we all took for granted. Children’s sporting endeavours may have temporarily ceased but so should the payments! Now is a good time to scrutinise your household costs and ensure any long-standing subscriptions are still relevant.

During this challenging period, it is more important than ever to keep lines of communication open so that you can understand how your stakeholders can work with you and support you. Everyone is facing huge challenges and changes, and that means there is also a huge potential for empathy amongst your stakeholders.

We shouldn’t forget that people may be feeling a whole range of emotions. Instead of sending an email, pick up the phone. Instead of phoning, set up a Zoom or Skype call.

There are some positives as well

The next few weeks and months are going to be difficult for everyone and we are going to have to actively look for the positives in the situation. We need to remember that others are suffering too and act with compassion. Here are a few positives I can take from the situation.

- The planet is going to breath a sigh of relief as planes are grounded and vehicles are used less. On my morning walks I have taken to stopping and taking in the sounds of birds and the gentle trickle of the stream and counting my blessings (yes, there are still lots of things to be thankful for).

- This is happening at the start of spring when we may be able to at least feel the benefit of (hopefully) warmer weather and we won’t have to heat our homes all day every day.

- We may find new and better ways of interacting with each other. It won’t replace face to face gatherings, but it is definitely a chance to be creative over the internet!

- We will all be flocking to bars, restaurants and hotels at the end of this and your business may be busier than ever!

What positives can you think of?

If your company provides you with a traditionally fuelled car for personal use, it can be a very expensive way to fund your vehicle. However, if your company provides you with an electric car that you can use personally instead, the tax tends to be substantially lower than for traditional vehicles and there are incentives for the company as well.

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.