Can my company buy a car for me to use?

Laura Arbuckle • February 20, 2020

Having access to a company car was once considered a status symbol. In recent years however, having use of a company car for private journeys has become less popular because of the high levels of tax that the employee is expected to pay.

The use of a company car is a benefit in kind and therefore the employee (or director) enjoying use of that car is taxed on the value of the benefit each year. The value that must be used is set by HMRC and an additional calculation is required if the company pays for fuel that is used for personal journeys. It doesn’t really matter how you extract funds from your company, you will be taxed on it regardless!

For a long time now, getting your company to buy a car for you has been one of the highest taxed methods of profit extraction. Yes, the cost of the car and its running costs are an expense of the company and therefore reduce the amount of corporation tax that the company will suffer. However, the tax you pay personally in order to use the car for personal journeys often outweighs the savings unless you reimburse the company.

How is the value of the car calculated?

The value of the benefit of having the use of the car is based on the list price of the car when new along with the CO2 emissions for the vehicle. You can find out some information including the CO2 emissions about your car by entering your number plate on the DVLA website here. Broadly speaking the value of the car for is likely to be in the region of a third of the list price of the car every year. This value is treated as if it were additional salary received by the employee and is therefore taxed at your prevailing income tax rate.

What about fuel costs?

If your company also provides you with fuel for personal journeys, you will also be deemed to have received a benefit in kind. Again, the value is calculated using the CO2 emissions for the vehicle to work out the relevant percentage but this time, the percentage is applied to a fixed amount set by the government, for 2019/20 this was £24,100. This value is again taxed at your prevailing income tax rate. If you are only using a small amount of fuel, then the tax incurred could be well in excess of the value of fuel you have made use of.

If you reimburse the company completely for the fuel that has been used for private journeys then there is no tax to pay and nothing to report to HMRC.

One way of avoiding the fuel charge is to purchase all the fuel for the car personally and to claim business mileage from the company when your personal car is used for business.

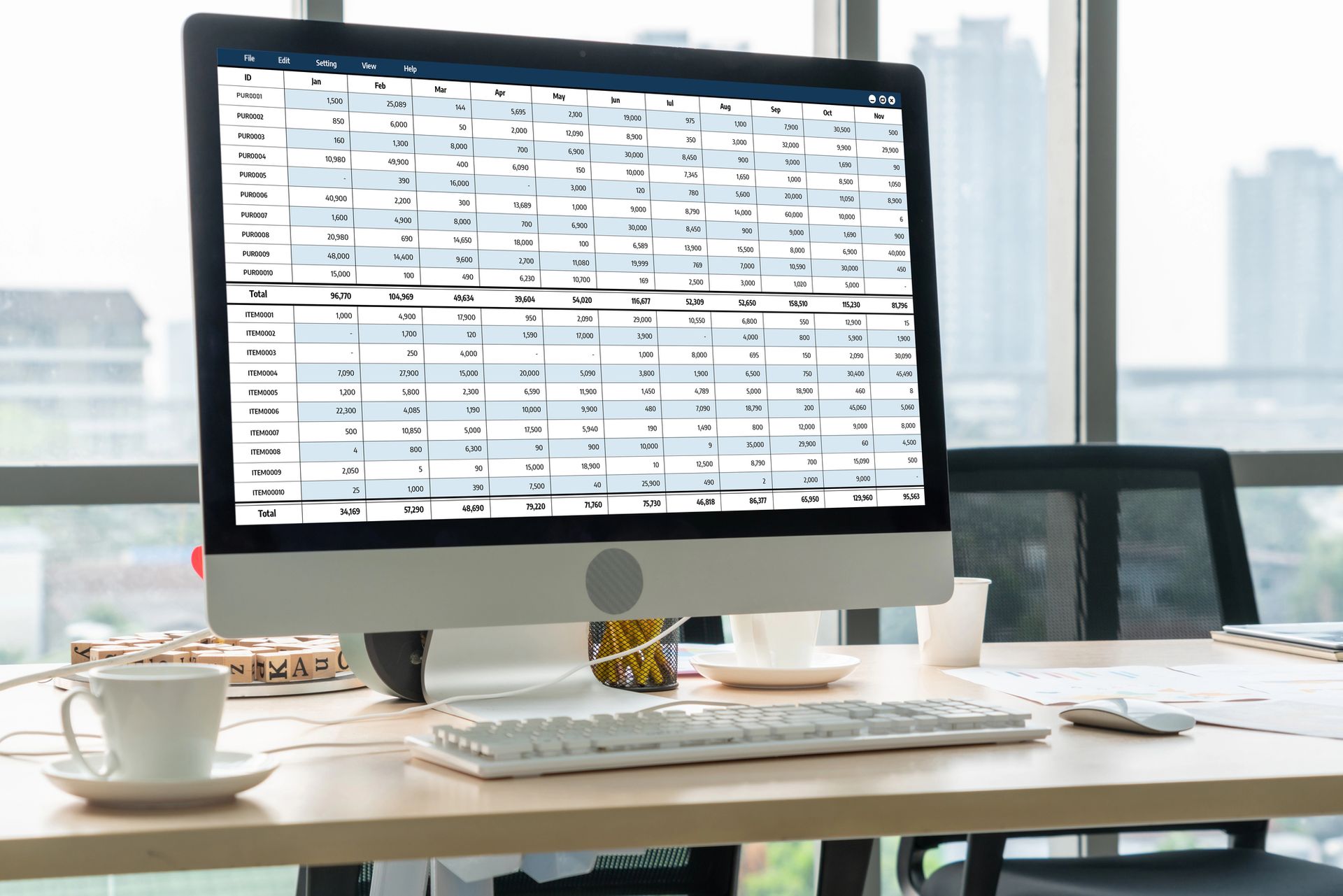

What is the easiest way to calculate the tax?

The easiest way to work out the tax you will need to pay on your company car is to use the HMRC calculator here

or the Parkers calculator here. The Parkers calculator handily includes the list price of many models of car, which can be difficult to track down if your company owns an older vehicle but the HMRC calculation also incorporates a calculation when you have only had access to the car for part of the year.

Would I be better buying an electric car?

Yes! For the 2020/21 tax year, the value of the benefit in kind you receive on fully electric company cars is 0%, meaning the employee has no tax to pay for private use of the car. This rate increases to 1% in 2021/22 and 2% in 2022/23 but this is a substantial reduction on the rate for other cars. At these percentages, it may be worth considering the provision of a company car for your employees again.

What about vans?

Vans are not taxed nearly as heavily as cars as they are less desirable as a vehicle for personal use. No benefit in kind arises if you use your van only for business journeys or provide a pool van that any employee can use. Even if you do use the van for personal journeys, the value of the benefit in kind is a fixed rate of £3,430 whilst fuel is taxed on a fixed value of £655. This is considerably lower than the rate for cars.

Because of the way the calculation takes place, the tax on a company car is particularly penal if you have use of an older car as the tax continues to be based on the list price of the car when new. If you are buying an older car it is almost certainly preferable to either buy it personally or even take additional salary to cover the cost of buying a car rather than the company buying it for you.

If you are considering buying a company car, it could be a good time to invest in an electric car so as to enjoy favourable tax treatment for the next 3 years.

Photo by Dominik Martin

on Unsplash

If your company provides you with a traditionally fuelled car for personal use, it can be a very expensive way to fund your vehicle. However, if your company provides you with an electric car that you can use personally instead, the tax tends to be substantially lower than for traditional vehicles and there are incentives for the company as well.

My residential landlord clients would probably tell you that they are fed up of hearing about HMRC’s latest requirements for reporting Capital Gains Tax. At every accounts review meeting I make sure they are fully aware that in the event they sell their residential rental property, they must complete a return and pay any tax that is likely to be due within 60 days of the sale being agreed.

If you are juggling your work-life balance, we can help you to find more time for yourself by helping you with your self-assessment return. You may be wondering how that might work in practice. I can’t speak for every accountant or payroll operator but in this blog post I describe how the process works at Armet Accounting.