Soletraders, set your motor expenses in motion

How to navigate car and van expenses for the self-employed

Depending on your product or service you may need to have a vehicle that you use in your business, but do you know how to record the expenses associated with that vehicle in your self-assessment return? Read on to find out more!

Unless you have a vehicle that you only use for business with no personal use, it is really important to keep an accurate record of your personal/business mileage. In order to do this, you should maintain a log of miles covered for business or personal use. I find the best way of doing this is by keeping a small notebook in my car and making a note of all my business miles in a given year, along with the mileage of the car at the start and end of the your business year. If you are predominantly covering business miles, it may be easier to keep a record of your personal miles instead. There are also apps available (such as Zoho, Everlance and MileIQ ) that may help you to maintain a log of your business miles as well.

There are two ways of working out how much it costs your business to operate your vehicle for tax purposes. The first is to record your actual costs and divide the costs between business and personal use. When recording the actual car and van expenses in your business you need to separate out the actual cost of purchasing the vehicle from the day to day running costs.

Running costs

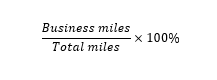

Use your mileage record to work out the proportion of business use to personal using the following formula.

Apply the business mileage percentage in turn to each of the running costs of your vehicle such as fuel, insurance, road tax and maintenance.

Purchase costs - this is the tricky bit!

When you

purchase a vehicle and use it in your business, there are a few ways you can

finance it and each of these ways are treated differently for tax

purposes. If you use cash to buy your

vehicle it is very easy to identify the actual cost to the business. If you instead use a loan or HP agreement to

finance the vehicle, you need to work out how much of the amount paid for the

vehicle is for the vehicle itself and what proportion is the cost of financing

the vehicle. You can usually find this

information on the loan or HP contract.

Only the interest payments on a loan or HP agreement are deductible for

tax by the business as they are incurred (based on the effective interest rate). Tax relief on the cost of

the vehicle is given by claiming capital allowances of 100% in the first year, 18% per year

or 8% per year depending whether it is a car with high emissions or a

different type of vehicle. All

capitalised costs are restricted to that business use proportion that we

calculated above.

Alternatively, some businesses choose to hire their vehicles by entering into an operating lease, under which they will never own the vehicle. In this case the monthly payment (restricted to 85% of the monthly payment for cars with emissions more than 135g/km) is an allowable deduction for tax purposes and there is no need to show the vehicle in the balance sheet. As with all motor expenses, any personal use should not be recorded as a business expense.

A final but less popular option for vehicles is a finance lease. Whilst similar in nature to HP the vehicle is never owned. The tax relief for the cost of the vehicle is deducted by allowing the depreciation of the vehicle to be deducted for tax purposes. Again, any personal use is not allowed as a deduction.

Simplified expenses

If all this is too complicated, don’t despair. Simplified expenses

are just that, a simple flat rate that you record for every mile covered in your vehicle for your business. For cars and vans this is 45p per mile for the first 10,000 miles and 25p per mile thereafter. If you use a motorbike in your business, the flat rate is 24p per mile. If you choose to apply the simplified rate then you don’t make a deduction for any other vehicle related expenses such as fuel, insurance, road tax and maintenance. Nor is there a deduction for the purchase of the vehicle. The rate per mile is designed to cover all of your running expenses. If you predominantly use your vehicle for personal use but occasionally use it for business, then this is probably the option for you.

If you aren’t sure which method of expenses to use, HMRC have a checker here that allows you to compare the two methods and select the right one for your business (remembering that once you choose which method to apply, you need to continue with the same method).

If I’ve got your head in, don’t worry. Give me a call on 07597546030 and I can chat you through all of the options with you.