How do I fill in my self-assessment return?

How to tackle the self-employment section of your tax return

This blog gives a snapshot of how to get started with your tax return. Tax returns can be daunting, so I’ve tried to set out how I would go about pulling together the information for the self-employment section as simply as possible. Remember to take a deep breath before embarking on the process!

Before we get started, I am going to assume that your turnover is under £85,000 so that you can use the cash basis to prepare your accounts. However, if you have interest charges of over £500, have a lot of stock, end up with losses or are looking to source funding for your business in the future, you may be better to produce accrual accounts.

Step 1 – Do you need to complete a tax return at all? If your trading or property income (note that it is income, not profit) is under £1,000 and you have no other sources of income to report then as of the 2017/18 tax year you do not have to submit a tax return at all, nor do you even have to register for self-assessment. Note that if HMRC has asked you to complete a return, you should complete the return or speak to them to get it cancelled!

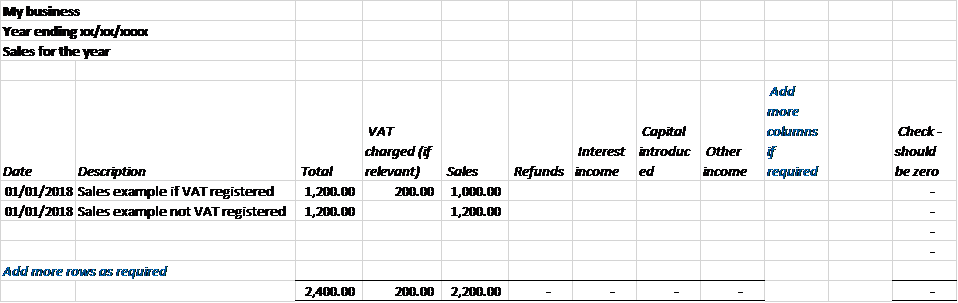

Step 2 – Gather all your sources of data together and download as much as possible into Excel. This may include bank statements, PayPal statements, Credit Card statements, Credit card income statements, petty cash lists or even a box of receipts. If you have a box of receipts, you may wish to download my basic spreadsheet as a basis for recording your transactions and write up your receipts as if you were creating a bank statement.

Even if you don’t have a separate bank account for your business you may find it easiest to download your full bank statements and identify which ones are personal and which ones relate to your business.

Step 3 – Sort your data into a usable format. Your information will download in various different formats and you may need to reformat it to make it useful. Personally, I prefer to split my income and expenses onto two separate tabs and look at them separately but it’s not impossible to do it all on one sheet. Remember to gross up your sales for any charges deducted by your card provider by noting the full amount charged to the customer as income and adding in the expense as finance charges. Following the examples below, organise your transactions into a different column for each type of income and each type of expense (eg stock purchased, staff costs, motor expenses, entertainment) that you wish to analyse. You can put all your expenses into one box on your return but you do need to review all your expenses to make sure they are allowable and this is easier to do by splitting out the detail from the start.

Note that any money you take out of the bank for personal use (including your payment of income tax for the previous year) should be allocated to proprietor’s drawings – they are not expenses of the business.

Step 4 – Reconcile your data to your downloaded statements. If you split your data between income and expenses, make sure it all adds back up again at the end to ensure you have captured everything. You should also check that your PayPal balance transferring into your bank account matches what was received into the bank. Likewise, any payments towards your credit card from your bank should match the payments received on your statements. Little checks like these can ensure that you are capturing everything completely.

Step 5 – Review your transactions to make sure that all of them are allowable for tax purposes.

- Check that any entertainment costs claimed are for staff entertainment up £50 per head only.

- You may find it easier to use the simplified expenses for motor vehicles (see step 6) in which case remove all motor expenses from the tax return and follow the simplified expenses below.

- You must account for personal use of any items from your business that you use yourself as if you have bought them from your business at the full retail price.

- Loan repayments, HP and finance lease payments are not expenses of the business. Only the interest is allowable.

- You can deduct a proportion of your cleaning costs if you work from home and have a cleaner.

- You can claim the expense of your mobile phone if you use it in your business.

Step 6 – Add in any additional expenses such as use of home as an office, mileage, etc. You can use the actual expenses and proportion them between personal and business use or you can use the simplified expenses shown below.

If you use your home as an office, you can claim the following based on how many hours you work from home.

| Hours of business use per month |

Flat rate per month |

| 25 to 50 |

£10 |

| 51 to 100 |

£18 |

| 101 and more |

£26 |

You may also find it easier to use the simplified expenses for motor vehicles in which case remove all motor expenses and only use your recorded mileage (not including travel from home to place of work) for the year to calculate your flat rate.

| Vehicle |

F lat rate per mile |

| Cars and goods vehicles first 10,000 miles |

45p |

| Cars and goods vehicles after 10,000 miles |

25p |

| Motorcycles |

24p |

Step 7 – Populate your data into the tax return

. You should now have all the data available to

be able to populate the turnover and total allowable expenses box on your tax

return. There is no need to split your

expenses into the separate boxes unless your turnover is over £85,000. Unless

you have other sections to complete, you can now rest on your laurels and feel

smug that you’ve got your return out of the way!

Every business is different and, in my experience, all have their little quirks or issues when it comes to the tax return. If at any time you are uncertain of how to treat an item in your tax return, feel free to get in touch.