VAT in the Construction Industry

Since releasing this blog, HMRC have delayed the start date for the reverse charge in the construction industry from 1 October 2019 to 1 March 2021. The rules aren't expected to change but there is longer to implement the changes.

How does it work just now?

At the moment, if you are a VAT registered business working in the construction industry you operate in exactly the same way as any other business in that you collect VAT on behalf of HMRC from your customers, see here for more details. You can reclaim any VAT you have incurred on your purchases and the net amount is passed to HMRC, usually on a quarterly basis.

What’s changing?

In an attempt to prevent fraud, HMRC are moving the construction industry to a reverse charge mechanism for VAT reporting with effect from 1 October 2020.

For many contractors working under the new rules, the reporting itself will be simpler although there will be an impact on the cashflows into the business. If your contract falls under the new rules, responsibility for accounting for and paying VAT moves from the supplier to the customer.

Simply put, it means that rather than charging your customers VAT and collecting it to pass onto HMRC, the customer themselves is responsible for the VAT.

What determines whether my contract falls under the new rules?

To work out whether you need to apply the reverse charge you need to consider the following issues.

1. Decide whether your work is part of the construction industry.

The HMRC definition of the Construction Industry work follows the same rules as the CIS scheme for payments (see the link here to find out the types of work that are included). Note that the supply of goods and materials is also caught under these rules, unlike the CIS scheme for services when the cost of materials is deducted from the invoice before the tax deduction is made.

2. Check whether your customer is VAT registered.

If your customer is not VAT registered, you should account for VAT in the normal way. You can check whether a customer’s VAT registration is valid here.

3. Decide whether your customer is an end-user or an intermediary

The end-user tends to be the person or business that has asked the main contractor to do the work, often the owner of the land or property on which you are working. Intermediaries are similar to end-users but are generally groups of businesses that may be working in partnership to obtain construction services. You may need to have a conversation with each of your customers to decide whether they are either an intermediary or an end-user of the services or not.

If your customer is not the end user, the reverse charge is applicable and the customer would be responsible for reporting the VAT to HMRC. Otherwise, VAT is charged in the normal way.If the reverse charge applies, what does this mean for my invoices?

As well as showing all the usual things that go on a VAT invoice , your invoice also needs to give the following information:

- A note that clearly tells the customer that the reverse charge applies and that they are responsible for accounting for the VAT due in their own VAT return.

- Either the amount of VAT that should be included in the reverse charge or the rate that should be used. Either way, the VAT should not be included in the amount due by the customer.

And what goes in my VAT return?

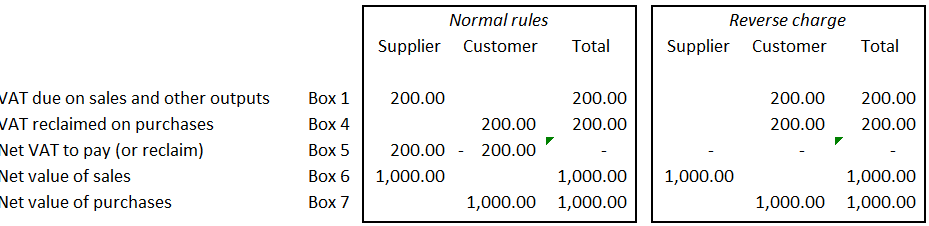

If you are the supplier, only the VAT you have charged to end-users or intermediaries is reported in Box 1 on your VAT return. The net sales figures are included in Box 6.

The customer then accounts for the VAT by including it in both Box 1 and Box 4, leaving a tax neutral position. The net purchases that you have made under reverse charge are stated in Box 7.

As demonstrated in the illustration above, the information and payment that HMRC receives remains the same, the reverse charge simply reduces the cash movements in the industry. The hope is that this reduction in cash movements will reduce the instances of fraud.

If your business falls under the new rules, you should be talking to your customers now to ensure that you are ready to account for VAT in the correct way from 1 October. You may also wish to consider whether you may be better to complete monthly VAT returns if you are likely to consistently reclaim more VAT than is payable to HMRC. Sage has a well-written blog herethat contains good advice for both contractor and subcontractors. Hereare the HMRC details in all their glory!