What do I need to know about VAT?

VAT - the basics

I thought it was about time I tackled the thorny topic of VAT. As the name suggests, VAT is all about taxing the value added at each step of the development of a product, whether the end product is goods or services. The intention is that only the end user of the goods or services pays the full amount of VAT, rather than the (potentially) many businesses involved in producing it for market. This is achieved by registered businesses charging VAT on their outputs and reclaiming the VAT on their inputs. At each stage, HMRC collects tax and then hands it to the next business in the chain, only keeping the tax when it is paid by a business or person that is not registered.

Businesses are simply acting as the collectors, the VAT you receive from your customers never belongs to you, you are simply collecting it on behalf of HMRC. It's not a bad idea to have a separate bank account to transfer the VAT you collect on sales into. That way, it's always there to make the payment when you need it and you can avoid a potentially nasty cash flow issue, not to mention the fines there may be if you don’t make the payment on time!

When do I need to register?

You must register for VAT when your turnover for the previous 12 months is higher than the VAT registration threshold, which is £85,000 at the time of writing. Find out how you measure turnover for VAT here. If your turnover is lower than this, you may register voluntarily if you wish. This may be a good idea if you have large capital items on which you would like to reclaim the VAT, you make zero rated sales and want to reclaim VAT on your inputs, or you want to pre-empt breaching the threshold. Some contractors are expected to register for VAT before they start work. You can register for VAT here.

Some businesses are likely to breach the VAT threshold more quickly than others. For example, a heating engineer with a high volume of materials that are then sold on to customers would reach £85,000 of turnover more quickly than an accountant where there are no such materials charged as part of the sales process. If you are in a business that uses a high volume of materials, you may prefer to register for VAT from the start and avoid problems later if you fail to register when you should have done.

There are also businesses that should not register for VAT. If you make exempt supplies such as health or education services (amongst others) you cannot register for VAT.

If I need to register for VAT, what happens?

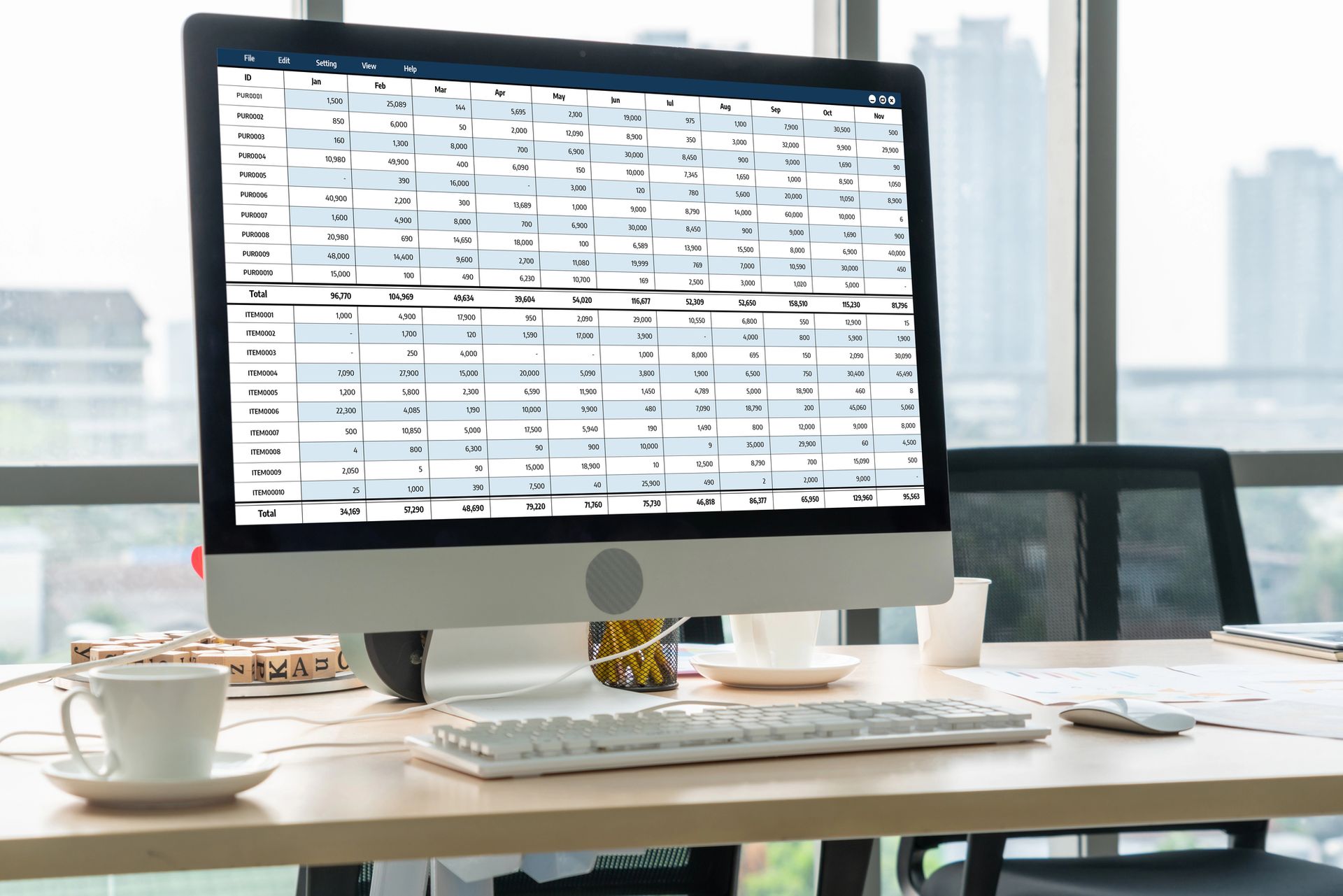

If your turnover is over £85,000 you will be expected to make digital VAT submissions from the outset. You will be expected to maintain digital records, including the underlying transactions with the date, amount and a description with digital links through to your tax return from the first day of being registered. You really need to keep a close eye on your turnover so that you can prepare in advance and be ready to make your first submission without having to enter many lines of data into bookkeeping software in order to submit your returns. The easiest time to start to use bookkeeping software is at the start of a new financial year as you will have all the opening balances available from completing your accounts and tax returns.

If you have registered for VAT voluntarily and your turnover is still below £85,000, you can log into your HMRC account and fill out the VAT return online to submit it. You can find out what you should put in each box of the VAT return here.

What can I reclaim?

You can only claim VAT on your purchases if you hold a VAT receipt. HMRC do occasionally perform VAT inspections and they will expect you to produce a receipt for every amount claimed. The easiest and safest way to draft your VAT return is by entering the data exactly as it is shown on each receipt. There are now products that make this easier so that you can scan your receipt and it will automatically identify the appropriate data and post it to your records.

What are the pitfalls?

Beware the difference between zero-rated , exempt and out of scope . Whilst none of these items have any VAT on them, zero rated and exempt sales and purchases should be shown in boxes 6 and 7 of the return, whilst out of scope items do not.

If you make a mix of VAT-able and exempt sales, you may end up being restricted in the amount of VAT you can reclaim in your expenses. For example, an osteopath may work with both humans making an exempt supply and animals, which would be standard rated. In this case, the amount of VAT you can reclaim is proportional to the amount of standard-rated supplies you make.

There is some debate as to whether purchases from non-VAT registered businesses should be classed as exempt or out of scope, personally I mark them exempt and include them in box 7.

Are there any other options?

HMRC do offer some schemes to assist with the preparation of VAT returns for small businesses. Those businesses on the cash accounting scheme only account for VAT when the cash changes hands. The flat rate scheme allows businesses to account for VAT using a single rate applied to their sales. In this case, VAT can’t be reclaimed except on large capital items.

VAT is a complex area of tax and it is not unusual for businesses to get caught out if they are not expecting to need to register, or fail to reclaim VAT for everything they are entitled to. Make sure you know if and when you will need to register for VAT. If you are in any doubt, make sure you ask!